Favorite Tips About When Should I Use Garch Halimbawa Ng Line Graph

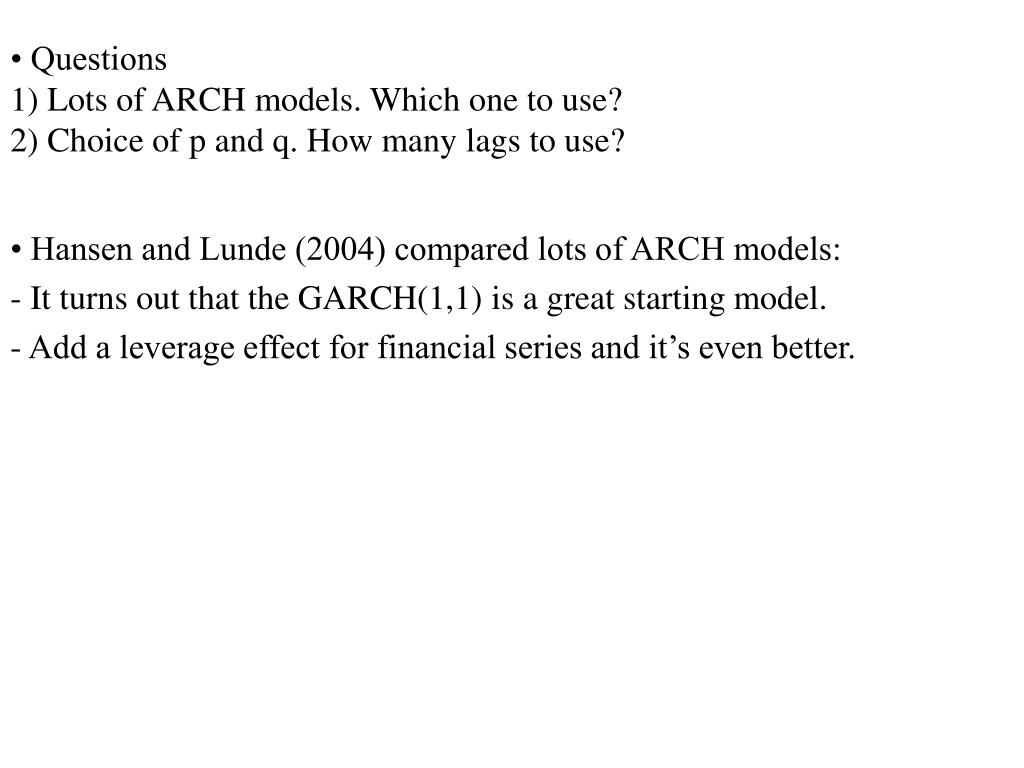

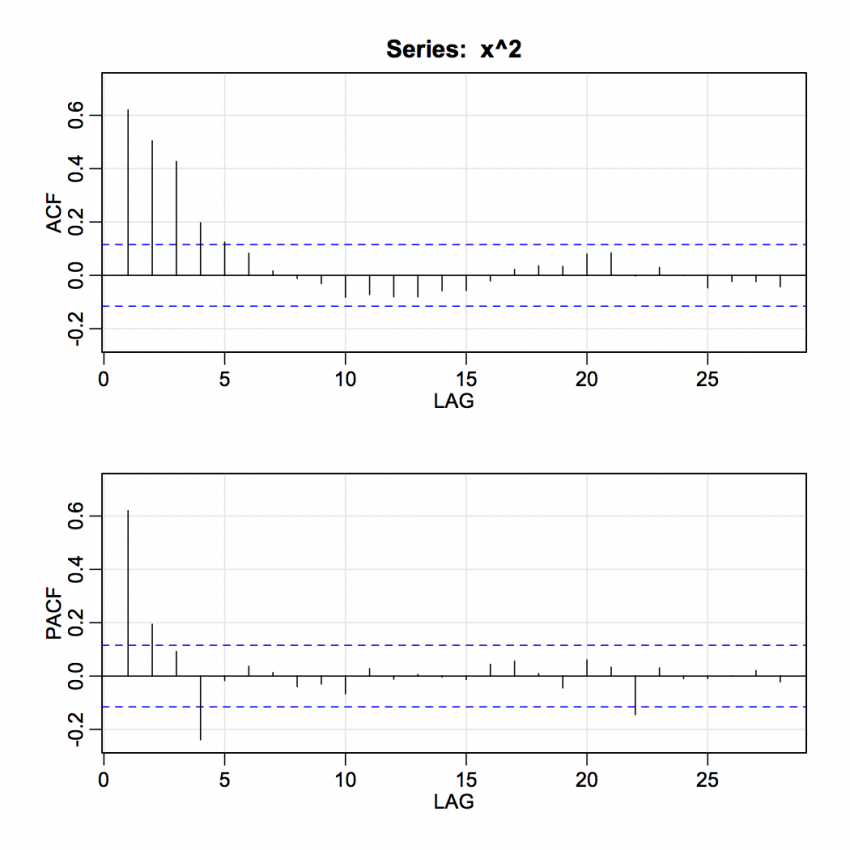

But then how do you determine the order.

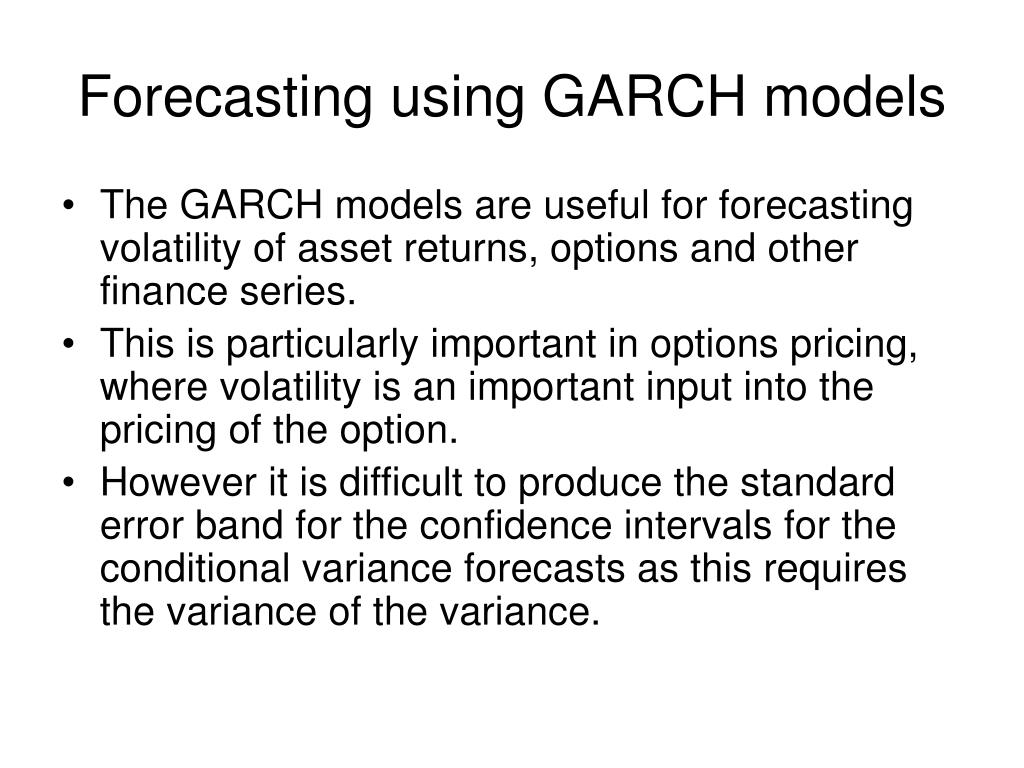

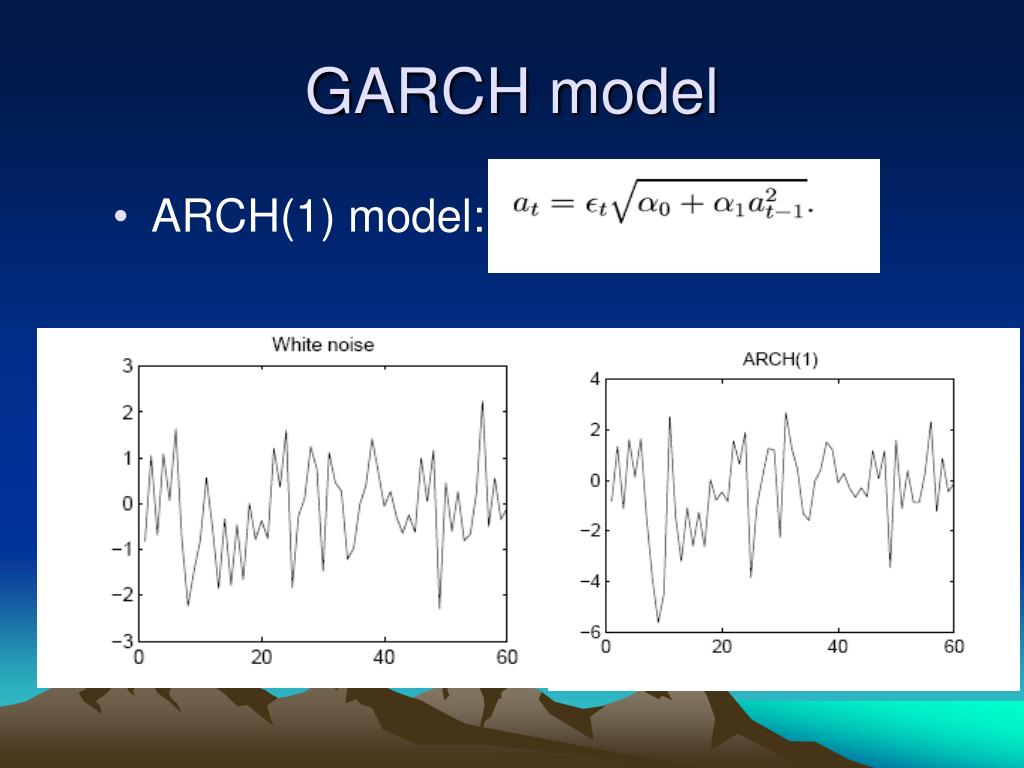

When should i use garch. If you are predicting with a time horizon of a month or more, then i’d be shocked if you got much value from a garch model versus a more mundane model. The reason why garch is useful is because it may better explain the volatility of certain series, particularly in finance. For instance, look at the graph below.

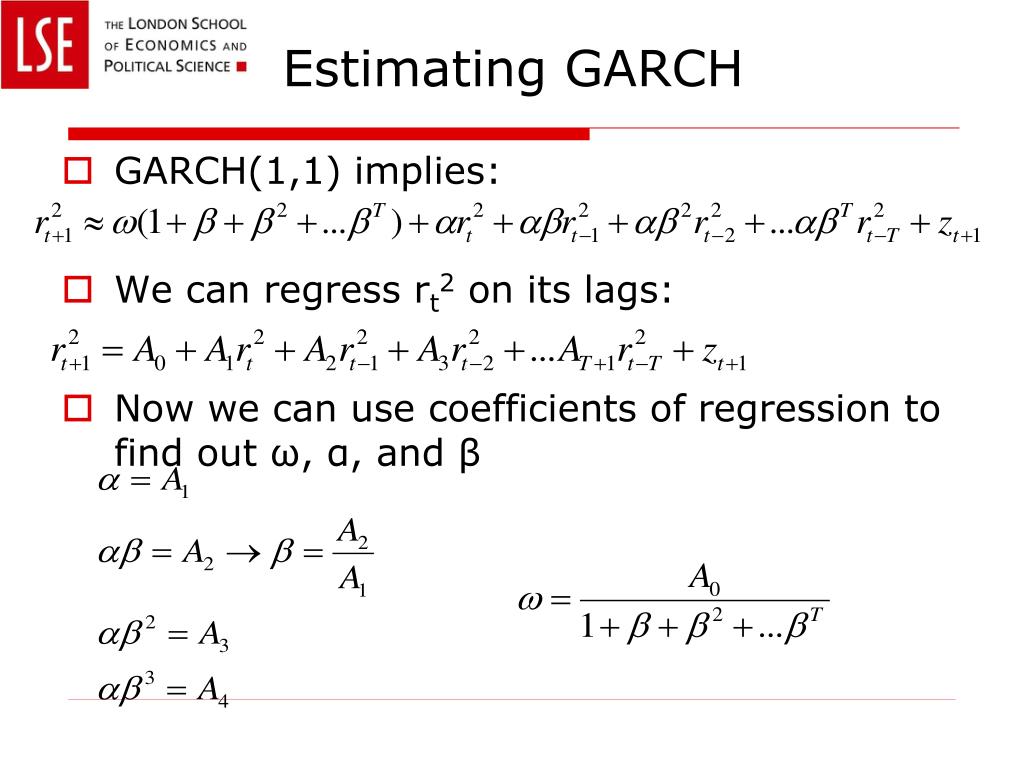

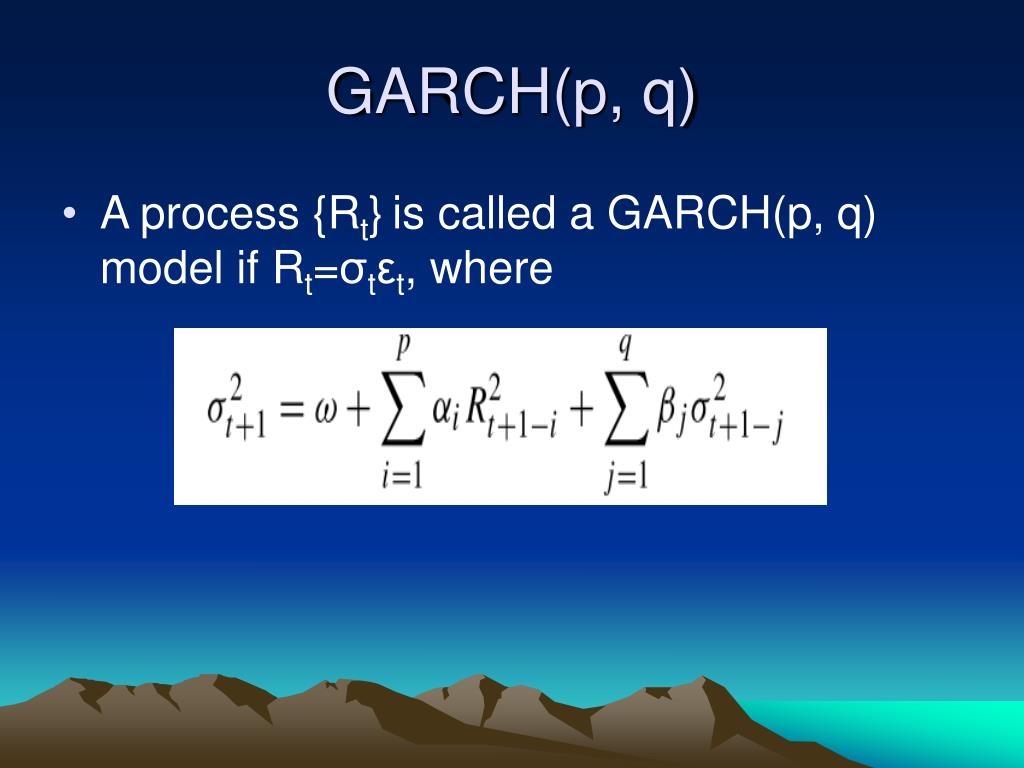

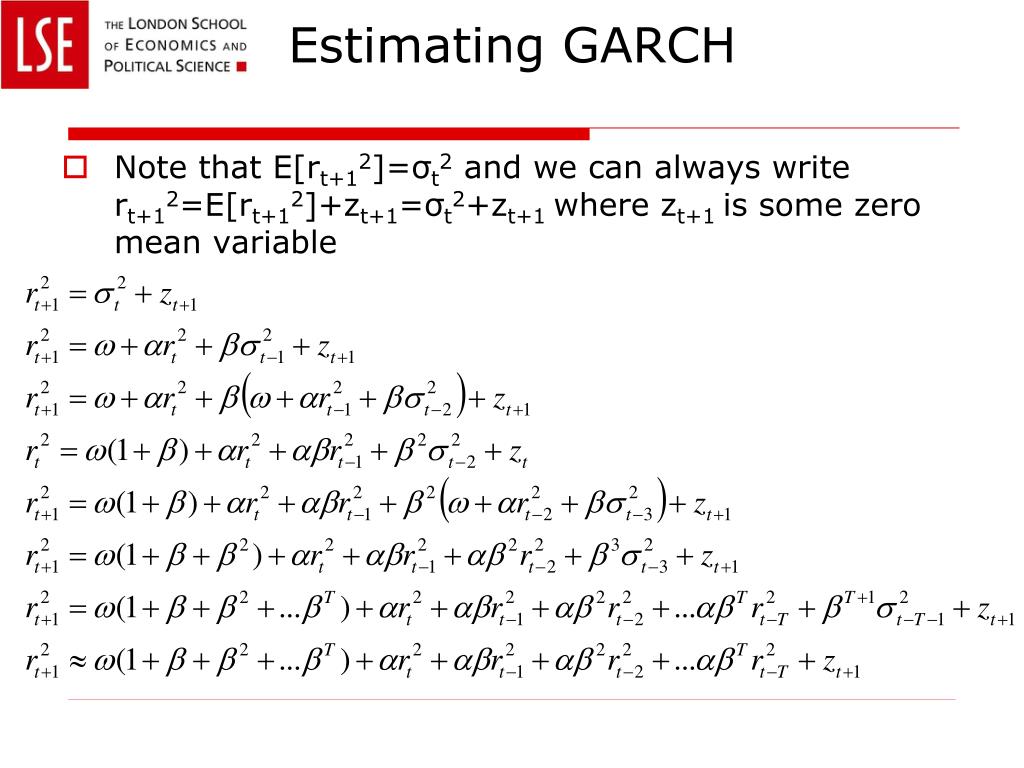

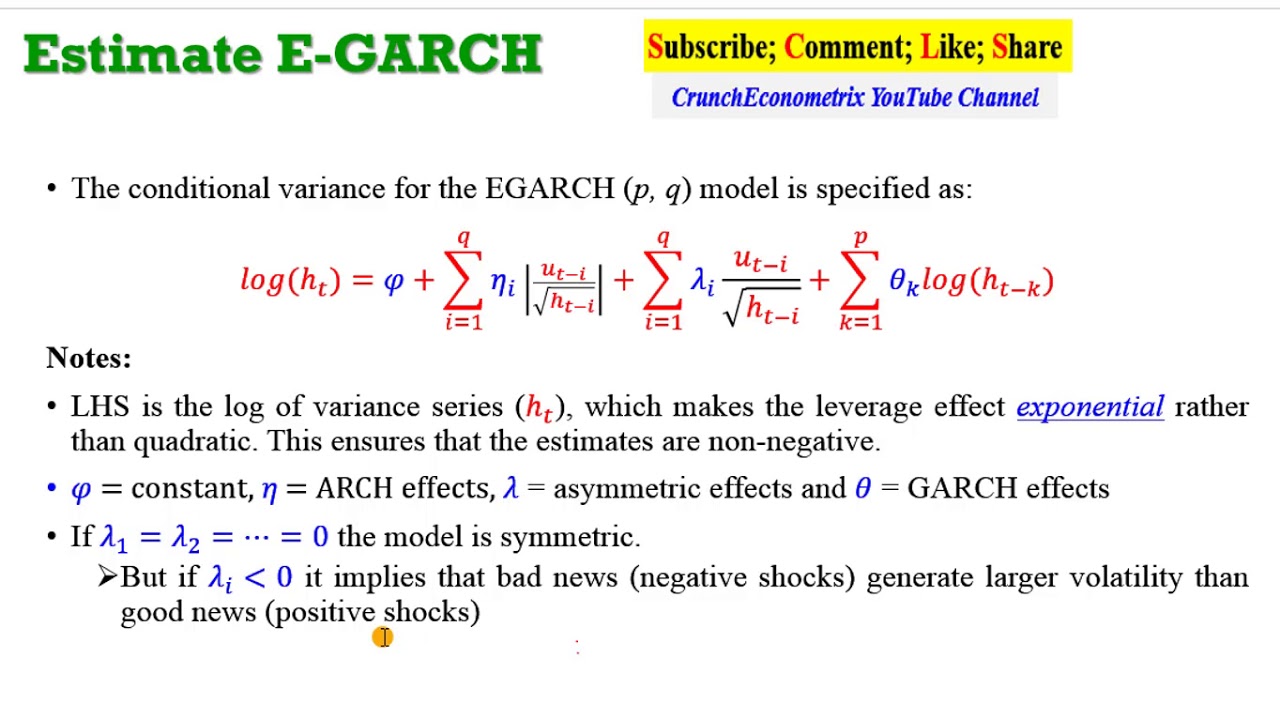

In order to model time series with garch models in r, you first determine the ar order and the ma order using acf and pacf plots. However, the nearly integrated behaviour of the conditional variance. If an autoregressive moving average (arma) model is.

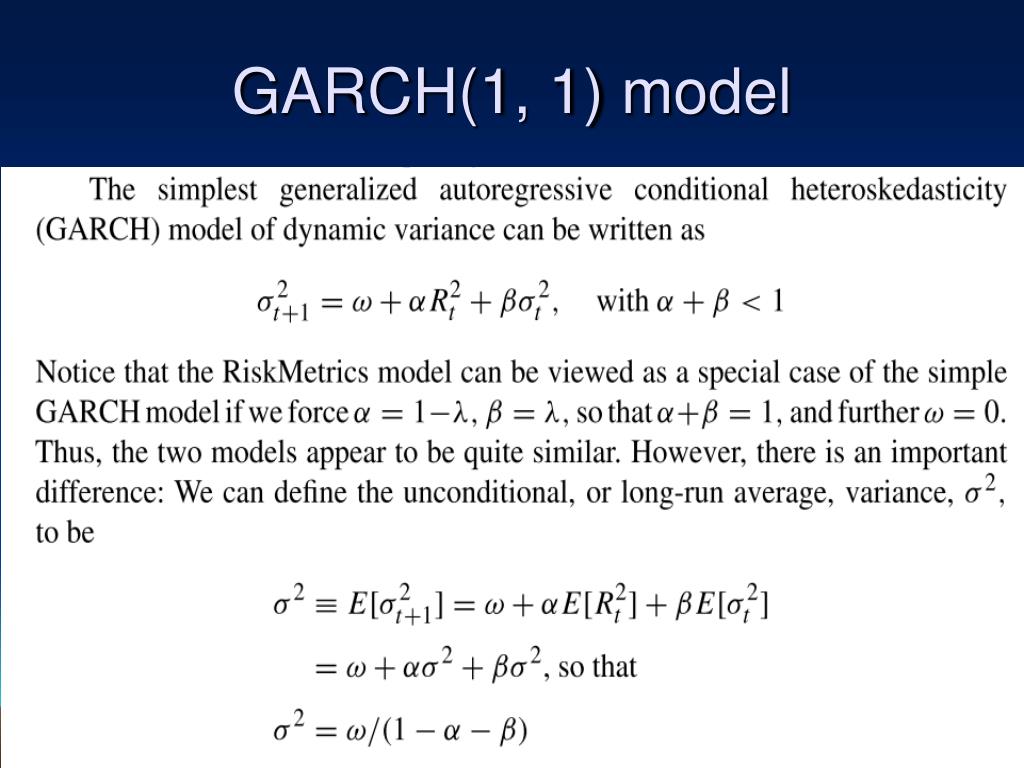

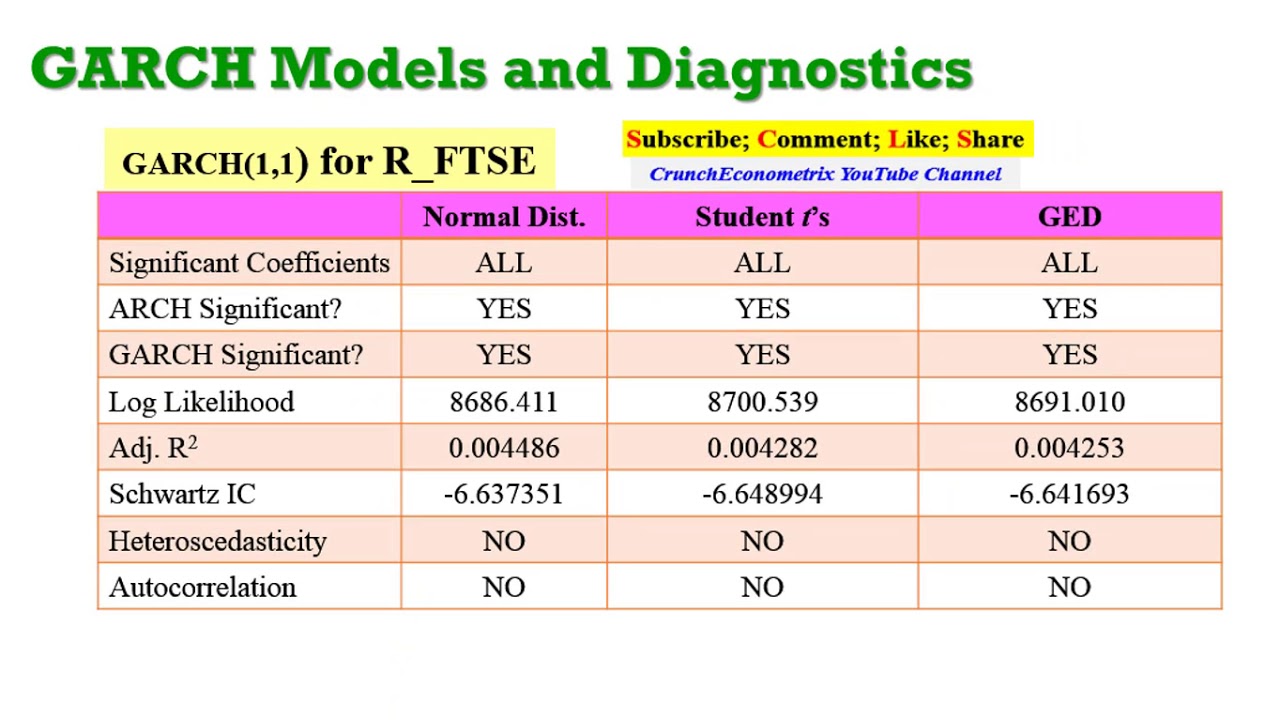

For simplicity and illustration we will use a garch(1,1) model before assessing and testing different specifications. You cannot know which model is preferred before you learn some characteristics of your data. Arch and garch models can generate accurate forecasts of future daily return volatility, especially over short horizons, and these forecasts will eventually converge to.

Arch and garch models have become important tools in the analysis of time series data, particularly in financial applications. A dose of methadone being dispensed at a clinic in rossville, ga. Its provisions typically bind the shareholders to make certain.

Indeed, if the price is divided by $2$ at a certain point in time, it'd give a return of $. The arch model is appropriate when the error variance in a time series follows an autoregressive (ar) model; To get basic standard addiction treatment, americans should move to canada.

Financial professionals prefer garch for its realistic volatility prediction in diverse market conditions. Depends on what you're trying to do. If you are predicting a few days ahead, then garch should be quite useful.

(adobe stock) gone are the days when a. In addition, if you fit a garch model with raw log returns, then you're also implicitly assuming the mean is zero. Picking up the phone and calling your employer to let them know you are unwell and unable to work is a considerate approach.

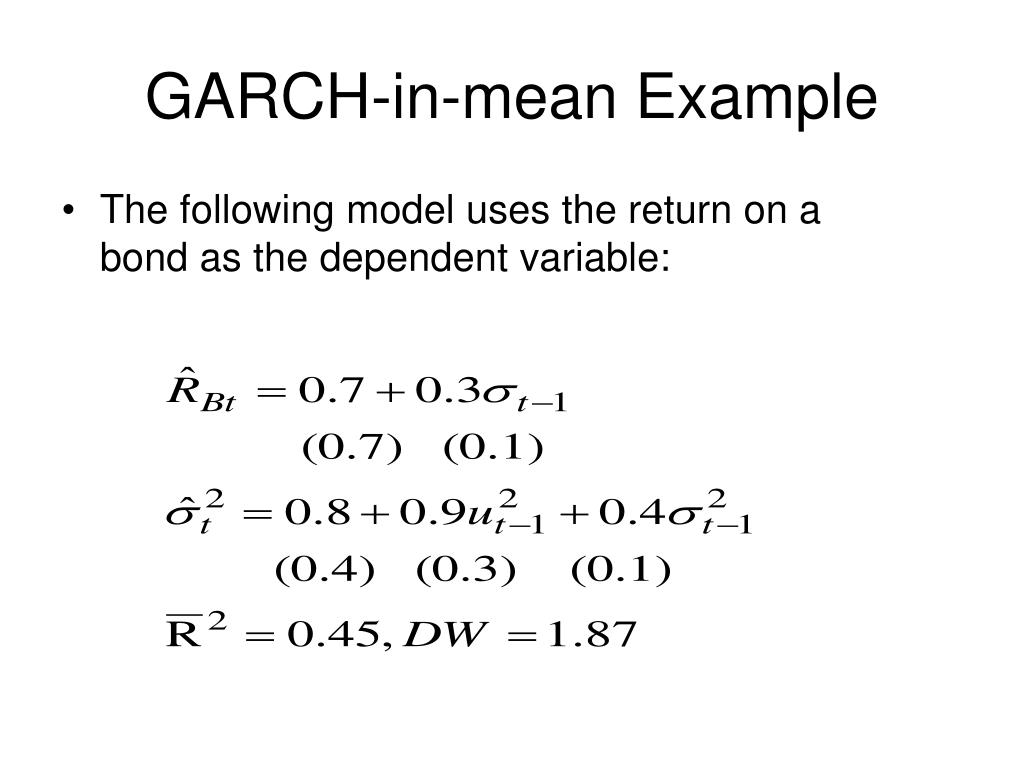

The garch model is the most used technique for forecasting conditional volatility. Modeling daily returns is most useful for short term risk analysis of assets and portfolios using volatility and var. These models are especially useful when the goal of the study is to analyze and forecast volatility.

A shareholder agreement (sa) is a legally enforceable contract signed by large shareholders. Cer model captures most stylized facts of. I use a standard garch model:

We will more formally test these effects. The garch updating formula takes the weighted average of the unconditional variance, the squared residual for the first observation and the starting variance and estimates. Garch models are not especially close to perfect.

:max_bytes(150000):strip_icc()/GARCH-9d737ade97834e6a92ebeae3b5543f22.png)

![[PDF] The Use of GARCH Models in VaR Estimation Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/5f2a00409f48ed4a596a36d6fdee3f82d8624f24/15-Table4-1.png)